PROVINCIAL ASSESOR'S OFFICE

SHORT DESCRIPTION OF OFFICE:

PROVINCIAL ASSESSOR’S OFFICE

The Provincial Assessor’s Office shall take charge of the discovery, classification, appraisal, assessment, and valuation of real properties within its territorial jurisdiction which shall be used as the basis for taxation.

The duties of this office include the preparation, installation, and maintenance of a system of tax mapping and records management and the preparation of the Schedule of Fair Market Values of the different classes of real property. .

- Requirements:

- a. Deed of Conveyance (Deed of Sale, Donation, etc.)

- b. Certificate Authorizing Registration (CAR)

- c. Transfer Tax Fee

- d. Tax Clearance for the current year

- e. Valid ID of the Transferee/ Special Power of Attorney/Authorization Letter if the Presenter is not the declarant.

- Requirements:

- a. Tax Clearance for the current year

- b. Valid ID or Special Power of Attorney/Authorization Letter if the Presenter is not the declarant.

- Requirements:

- a. Approved Subdivision/Consolidation Plan from the Department of Environment and Natural Resources (DENR).

- b. Tax Clearance for the current year

- c. Valid ID or Special Power of Attorney/Authorization Letter if the Presenter is not the declarant.

- d. Letter Request of the Declared Owner

- Requirements:

For Land

- a. Affidavit of Ownership

- b. Certified true copy of Original Certificate of Title (OCT)

- c. Certification from the Barangay Captain wherein the real property located

- d.Certification of Alienable and Disposable (A&D) from the DENR

- e. Ocular inspection from the Municipal Assessor

- f. Certification from the municipal assessor that this property has no existing Tax Declaration

- g. Ten Years back Taxes issued from the Municipal Treasurers Office

For Building and Machineries

- a. Sworn Statement from the declared Owner

- b. Building Permit from the Municipal Engineering Office

- Requirements:

- a. Lien and Encumbrances documents duly registered by the Register of Deeds (ROD)

- b. Tax Clearance for the current year

- c. Valid ID or Special Power of Attorney/Authorization Letter if the Presenter is not the declarant.

- HOW TO AVAIL THE SERVICES

- a. Submit complete requirements to the Office of the Provincial Assessor for proper verification

- b. Sign office Logbook, and

- c. Fill out Request Form signed by the Provincial Governor or his authorized Representative.

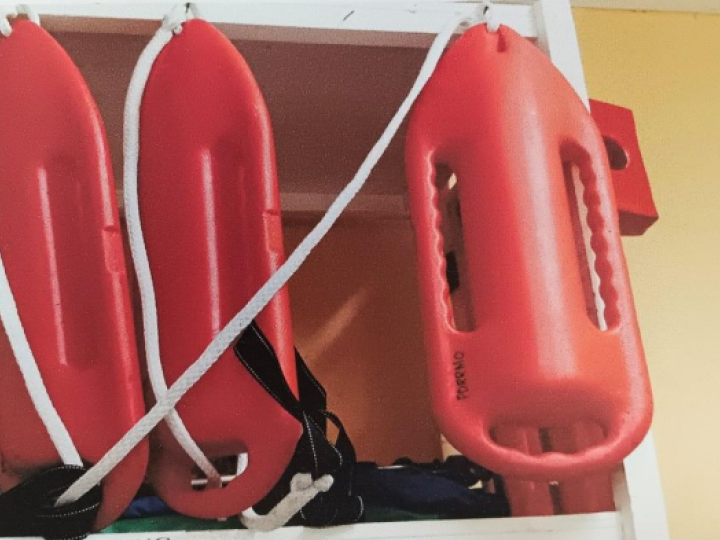

1.PREPAREDNESS PROGRAM - CONDUCT TRAININGS ON BASIC LIFE SUPPORT, STANDARD FIRST AID AND WATER SEARCH AND RESCUE

General Revision of Real Property Assessment

Pursuant to Section 219 of Republic Act (RA) 7160, otherwise known as the Local Government Code of 1991, The Provincial Assessor shall undertake a General Revision of Real Property Assessment two (2) years after the effectivity of the abovementioned code and once every three (3) years thereafter.

For this purpose the Provincial Assessor together with the Municipal Assessor shall prepare the schedule of fair market values for the different kinds and classes of real property within the territorial jurisdiction of the province which is the basis in the computation of taxes of all real property.

2. IMPLEMENTATION OF COVID-19 PROTOCOLS

Real Property Tax Appraisal and Assessment Project

Real Property Appraisal and Assessment operation is acknowledged to be one of the major sources of revenue in the Local Government Unit. While real property taxes remain a meaningful source of local taxes, this revenue source offers potential platform that would provide one of the solutions to the quest of Local Government Units (LGUs) in building capacity for their development needs, thus real property appraisal and assessment operations play an important role in the local government finance as a source of income and augmenting of funds for basic services, for the local school board, and barangays.

During the pandemic, the province improved its destinations and vigorously implemented projects to provide a convenient, seamless, and more unforgettable island experience for tourists. Among the major tourism projects that were put in place in order to meet this goal, the province launched the Camiguin Tourism Pivot and Transformation Plan to help meet the needs of organizations, groups, and industries severely affected by the pandemic, the Mantigue Island Development Plan, and the E-ticketing system that will digitalize the bookings and payment of tourists who will visit the tourist sites.

By the new tourism brand, the goal of the province is to enhance tourist’s experience, reach the pre-pandemic level of 800,000 tourist arrivals, and to breach one million by the year 2025.

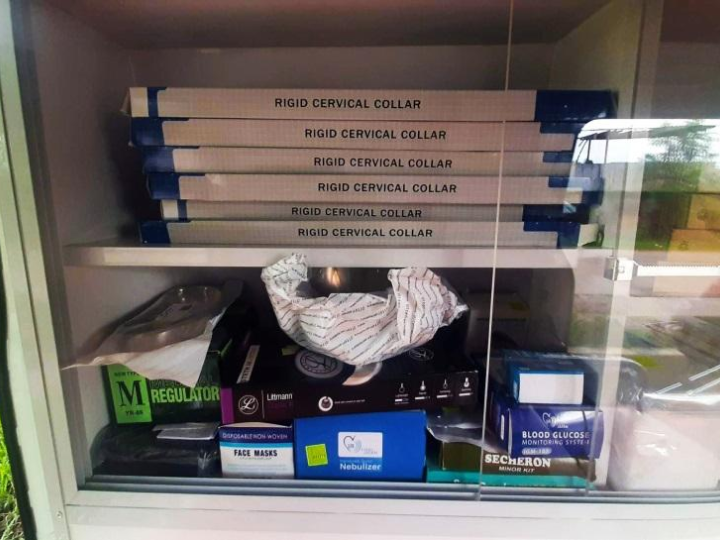

3. PROCUREMENT OF AMBULANCE AND RESCUE EQUIPMENT

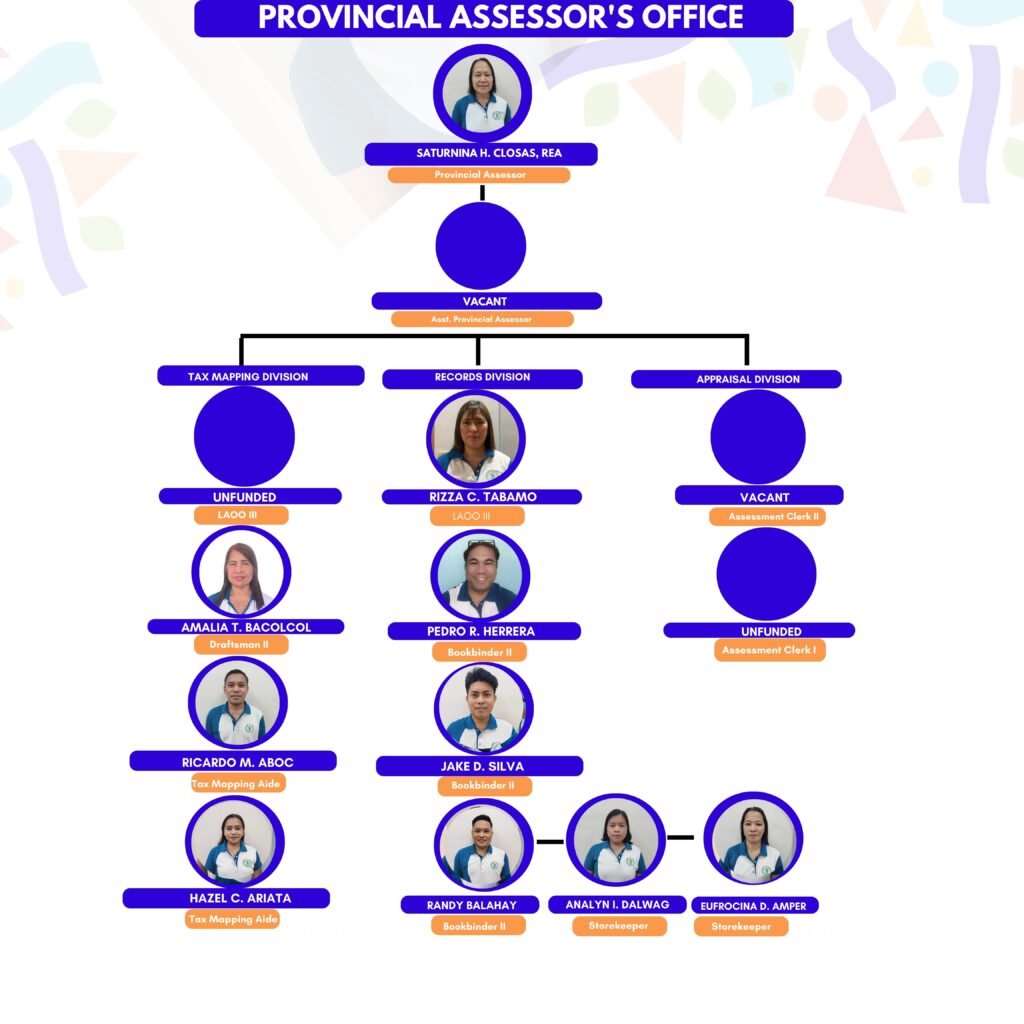

ORGANIZATIONAL STRUCTURE

SATURNINA H. CLOSAS

PROVINCIAL ASSESSOR

VACANT

TAX MAPPING DIVISION

RECORDS DIVISION

APPRAISAL DIVISION

UNFUNDED

RIZZA C. TABAMO

VACANT

AMALIA T. BACOLCOL

PEDRO R. HERRERA

UNFUNDED

RICARDO M. ABOC

JAKE D. SILVA

HAZEL ARIATA

RANDY BALAHAY

ANALYN I. DALWAG

EUFROCINA D. AMPER

RESPONDERS TEAMS

Team A

- MR. JOMAR G. EÑOLA

- MR. JAYBE S. MONTALBA

- MR. JOMAR G. BADANA

- MR. JOHN PAUL SABUERO

- MR. RUBEN O. PACUDAN

- MR. VAN LLOYD A. RAÑOA

- MS. AIVIE R. TESOCAN

- MS. JOCELYN G. PORTRIAS

- MS. MICA C. MICULOR

Team B

- MR. CARLO ANGELO M. GAVAS

- MR. LOI D. MAÑOZA

- MR. CORVEN C. BACAMANTE

- MR. KINICHI T. LOGARTA

- MS. JERAMIE M. DAGOHOY

- MR. AR AR RANARA

- MS. MARIA RONELA G. ABAO

- MS. ROXANNE JOY P. OCATE

- MS. JEWEL ANN T. OCLARIT

- MR. NUMERIANOS. ARDESA