PROVINCIAL TREASURER'S OFFICE

SHORT DESCRIPTION OF OFFICE:

An office focusing on the four thematic areas of DRRM; such as Disaster Prevention and Mitigation, Disaster Preparedness, Disaster Response and Disaster Rehabilitation in achieving the objective of reducing risk as well as addressing the pre-existing risks in the province to promote a safer, adaptive and disaster resilient Filipino communities.

The Provincial Treasurer’s Office is responsible for managing the finances of the provincial government. Its main functions include collecting and managing taxes, distributing funds to local government units and agencies, managing public debt, and maintaining financial records and reports. The office also provides financial services and assistance to the public, including tax collection, issuance of licenses and permits, and other financial transactions. Its goal is to ensure the efficient use and management of public funds to support the delivery of public services and promote the economic development of the province.

[smartslider3 slider="2"]

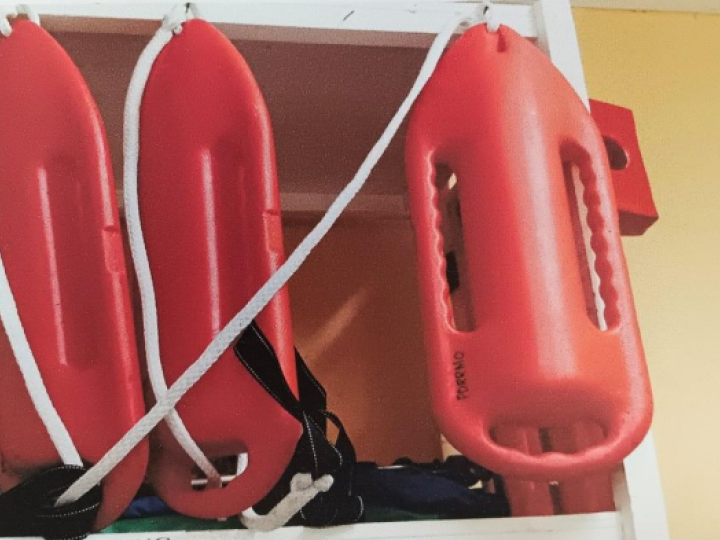

1.PREPAREDNESS PROGRAM - CONDUCT TRAININGS ON BASIC LIFE SUPPORT, STANDARD FIRST AID AND WATER SEARCH AND RESCUE

These trainings are a vital life skill that provides the responders with the basic knowledge, attitude and skills in dealing with medical emergencies.

2. IMPLEMENTATION OF COVID-19 PROTOCOLS

Continuous monitoring and verification process of documents are still present upon entry/exit in each port of entry in the province.

[smartslider3 slider="3"]

[smartslider3 slider="4"]

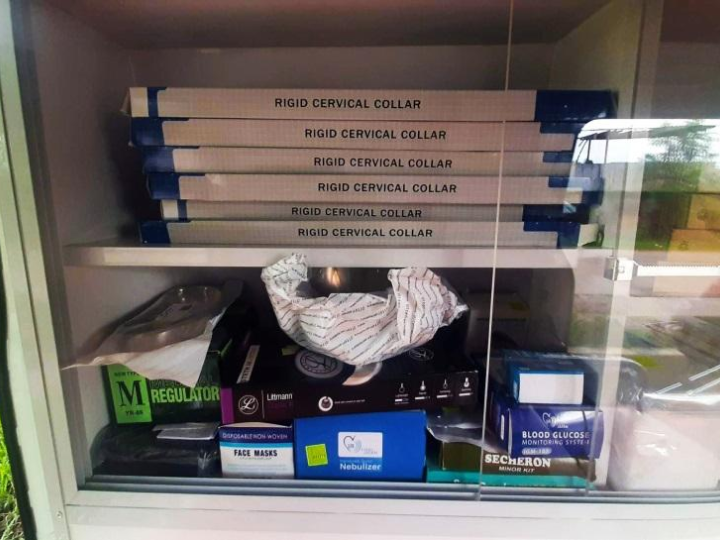

3. PROCUREMENT OF AMBULANCE AND RESCUE EQUIPMENT

SERVICES

Who may avail:

Taxpayer

CHECKLIST OF REQUIREMENTS

WHERE TO SECURE

- Order payment or slip if necessary

- From assessor’s/agriculture’s Office/PVO/ PGO/ depending on nature of payment.

CLIENT STEPS

AGENCY ACTION

FEES TO BE PAID

PROCESSING TIME

FORMS

PERSON RESPONSIBLE

1. State the nature of his payment.

1. Receive the payment

Base on tax ordinance

10 minutes

Payment Order

Accountable Form # 51

Collector

2. Pay in check (Voucher)

2. Issues official receipts with taxpayer names, date filled up (if voucher in the form used

3. State the name of

taxpayer

TOTAL:

Who may avail:

Suppliers/Creditors; Employee/Officials; Other offices who have claims from LGU-Camiguin

CHECKLIST OF REQUIREMENTS

WHERE TO SECURE

- Order payment or slip if necessary

- From assessor’s/agriculture’s Office/PVO/ PGO/ depending on nature of payment.

CLIENT STEPS

AGENCY ACTION

FEES TO BE PAID

PROCESSING TIME

FORMS

PERSON RESPONSIBLE

1. Community tax certificate

1. Present voucher or payroll

Base on tax ordinance

10 minutes

Disbursement Voucher or Payroll

Cash Clerk or

Cashier III

Disbursing Officer

2. Present community tax I.D., SPA or written authorization if necessary

2. Check the I.D. SPA on written

3. State the name of

taxpayer

3. Have the voucher or payroll or signed for claimant payment

4. Receive or attached to voucher

5. Write the OR number, date on voucher/payroll

6. Issue the check or pay corresponding cash

TOTAL:

ORGANIZATIONAL STRUCTURE

ZOSIMO D. SALCEDO JR.

PROVINCIAL TREASURER

VACANT

ASSISTANT PROVINCIAL TREASURER

CASH SECTION

TREASURY REVIEW SECTION

REVENUE OPERATION SECTION

FIELD SUPERVISION SECTION

UTILITIES

MARY LUSSEL S. PACTO

CASHIER III

CONSUELO B. CAJILLA

LOCAL TREASURY OPERATIONS OFFICER III

DORIE F.

OCLARIT

LOCAL REVENUE COLLECTION OFFICER III

JOSELITO P. CADELIÑA

LOCAL TREASURY OPERATIONS OFFICER III

OLIGARIO B. RAGAS JR.

UTILITY I

AIDA R. UGSOD

CASHIER I

EDMOND T. MAGRACIA

LOCAL TREASURY OPERATIONS OFFICER II

CLINT RYAN P. GASCON

LOCAL REVENUE COLLECTION OFFICER III

MA. LAARNI A. GOMEZ

UTILITY I

ARCELI B. GADGUDE

DISBURSING OFFICER II

CHRYST ANGELA A. NAKILA

LOCAL TREASURY OPERATIONS OFFICER I

NIÑO JUBILEE E. DALEON

REVENUE COLLECTION CLERK II

ERABELLE T. BERDOS

REVENUE COLLECTION CLERK II

VACANT

CASH CLERK II

RESPONDERS TEAMS

Team A

- MR. JOMAR G. EÑOLA

- MR. JAYBE S. MONTALBA

- MR. JOMAR G. BADANA

- MR. JOHN PAUL SABUERO

- MR. RUBEN O. PACUDAN

- MR. VAN LLOYD A. RAÑOA

- MS. AIVIE R. TESOCAN

- MS. JOCELYN G. PORTRIAS

- MS. MICA C. MICULOR

Team B

- MR. CARLO ANGELO M. GAVAS

- MR. LOI D. MAÑOZA

- MR. CORVEN C. BACAMANTE

- MR. KINICHI T. LOGARTA

- MS. JERAMIE M. DAGOHOY

- MR. AR AR RANARA

- MS. MARIA RONELA G. ABAO

- MS. ROXANNE JOY P. OCATE

- MS. JEWEL ANN T. OCLARIT

- MR. NUMERIANOS. ARDESA